by H.W. Thisuri Jayathma

Published on Ceylon Today on 03rd December 2024.

Currency devaluation is a widely discussed topic at present. There are constant discussions about whether the exchange rate should appreciate or depreciate due to its impact on economic activity. However, it is imperative to look into the pros and cons of currency devaluation. Opponents of devaluation express that any depreciation of the Sri Lankan rupee leads to an increase in the domestic price of goods and services. Examining the economic impact of an exchange rate depreciation positively drives economic recovery. Therefore, the objective of this article is to explain how it positively impacts financial recovery and the national security of Sri Lanka

Marshall-Lerner condition and currency depreciation

According to Chandrarathne, Jayasundara, Perera and Navaratne (2020), theoretical aspects indicate that the depreciation of the home currency against foreign currency does not essentially negatively impact the home currency. Instead, it will bring both pros and cons to the home country as expressed by Dell’Ariccia, 1999. Depreciation of the domestic currency will lead to an increase in the demand for exports of the home country and decrease the imports to the home country as mentioned by Chandrarathne et al., 2020. Finally, it tends to increase the consumption of domestically produced goods and increase domestic production. Further, the final effect of imports and exports on the BOP will gradually decide the result of Currency Depreciation (CBSL of Sri Lanka, 2020)

The Salvatore (2019) noted that the final impact of the currency depreciation on the trade account is determined by both import and export price elasticity. If the price elasticity of imports is elastic then depreciation or devaluation of the currency will lead to an improvement in the current account balance. As a result of that, reduction of the home currency import prices due to currency depreciation. If the price elasticity of exports is elastic the demand for exports by the world will increase due to the lower price of the domestic goods due to the foreign currency. This is the combined effect of import price elasticity and export price elasticity will determine the exact import of the trade balance

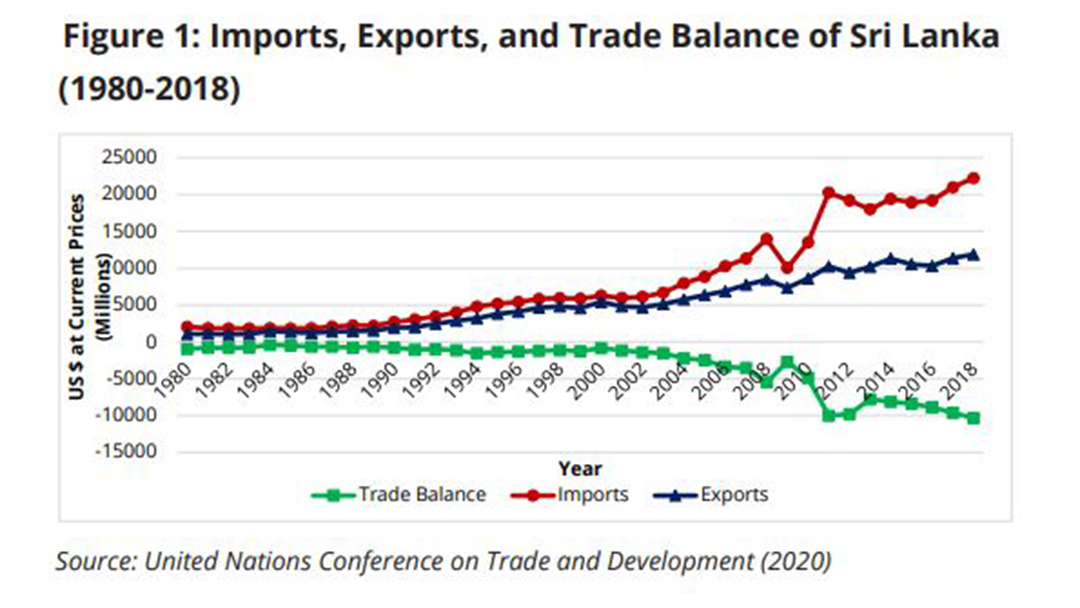

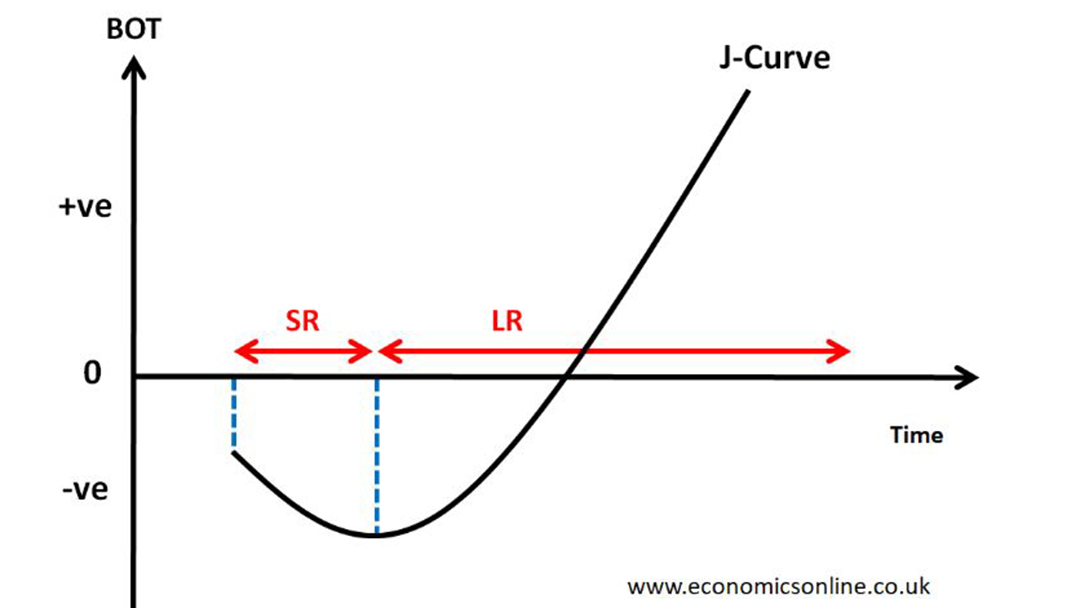

The above scenario can be explained using Marshall Lerner’s condition. According to the price elasticity of demand for imports and the price elasticity of demand for home country exports is greater than one the balance of trade account will improve with the depreciation of domestic currency. This scenario was tested by Chandrarathne et al., (2020) by using real data collected by the CBSL. They use 1980-2018 export expenditure and import expenditure data to prove the scenario. As their estimated value suggests that trade balance should worsen in Sri Lanka as a consequence of the depreciation of the Sri Lanka rupee against the foreign currency. Further, when using J-curve effect shows that a country that devalues it’s currency trade balance gets worse before it gets better.

Though the Marshall-Lerner condition applies to the Sri Lankan context it’s behaviour is not advantageous to the country due to the prevalence of low values of total export and import elasticity. The reason for this is that the export basket of Sri Lanka is currently composed of relatively low price- sensitive goods such as Tea, Coconut, Spices, Rubber products and Petroleum products. However, having non-traditional items in the export basket can lead a to high substation role in the global value chain which would be beneficial to Sri Lanka and initiate trade agreement with countries like India, the United Kingdom and Turkey. Having high export price elasticity would generate benefits to Sri Lanka. On the import side, it is crucial to manufacture substitutes for importing intermediary items in domestically. Finally, we can conclude having a strong export bucket and low-level import expenditures can have a huge amount of effect on trade balance which would lead to a favourable impact for the BOP deficit in the country. So it can help attract valued investment to the county. When we know sensitive variables like Net Export (NX) and Investment (I) become a favourable amount it leads to an increase in the National Income (Y) of the home country.

Currency depreciation and national security

According to George, George, & Baskar (2022); Sharma, Anawade & Sahu (2022); and Hemachandra, (2012) Sri Lankans face an economic and political crisis, which continues with high inflation and sporadic demonstrations throughout the country. As the cost of imports rises due to a weaker currency, the government may allocate less money for military expenses. However, in the Sri Lankan context external and internal environments changed during the last three decades. According to Alphonsus (2021) the Sri Lankan Government continuously increased military expenses because of national security threats. According to Rastogi (2023) geo-political vulnerability can occur in a country with a depreciating currency. For example the Venezuelan Bolivar Crisis (2013-Present), The Eurozone Debt Crisis (2010-2015), the impact of the Covid-19 pandemic on Global Currencies (2020-Present), the Turkish Lira Crisis 2018-2021), the Argentine Peso Devaluation (2019) low level of performances records due to economic and political turmoil in the country (Valiante 2011; Rastogi, 2023). This scenario can affect geo-political alliances and a country’s ability to manage foreign relations effectively. In the Sri Lankan crisis, the previous regime and its leaders took more actions to control the situation and stabilise the country’s economy, Political and military stability through their new policies and strategic decisions (IMF, 2024). On the other hand, in this kind of situation countries face migration pressures and regional instability. According to statistics from the Ministry of Labour and Foreign Employment (2023), migration pressure can occur because citizens seek better opportunities abroad. This leads to decreases in the country’s skilled labour force. Due to currency depreciation, it can spread to a neighbour’s country as well. Depreciation of one country’s currency can spill over to another and affect regional instability. Due to the Sri Lankan crisis the Indian Government gave their support to sustain essential imports and maintain sufficient foreign currency reserves to avoid defaulting on multilateral creditors (Panduwawala, 2024). Finally, the government can effectively manage the impact of currency depreciation by implementing sound fiscal and monetary policies. It can soundly affect the regain the economic power and economic recovery, country sovereignty, and internal stability and defend against both internal and external threats.

Link to the original source : Click here

* Ms. H.W. Thisuri Jayathma is an Intern (Research)at the Institute of National Security Studies (INSS), the premier think tank on National Security established and functioning under the Ministry of Defence. The opinion expressed are her own and not necessarily reflective of the institute or the Ministry of Defence.