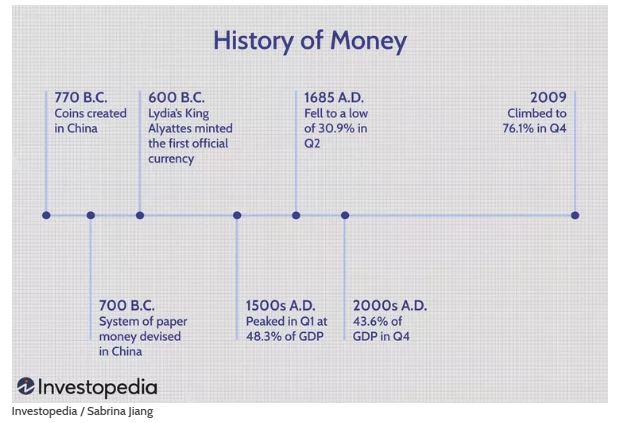

Money and currency are interrelated but have major differences. Currency is one of the forms of money. The Government issues it and it is the type of payment that people can use within the jurisdiction (United States Dollar [$] and Sri Lankan Rupee [LKR]). However, money refers more broadly to a system of perceived value that allows the exchange of goods and services. It serves as a unit of account, providing a common base for prices, a store of value, which means that people can save it and use it later, and a medium of exchange, which people can use to buy and sell from one another. Before the invention of money, people exchanged one type of good or service for another but it was inefficient and had limitations because of the double coincidence of wants. Then, societies evolved. They used commodity money (shells, beads, salt, grains) to accomplish their wants and needs. After introducing the metal coin, it marked a significant advancement in the history of money and it was remarkably durable, portable and easily divisible. As a result of that, coins spread rapidly across civilisation. After 700 BC, China introduced a system of paper money to the global economy due to the innovation of paper. Then, the invention of paper money and the development of the banking system allowed for the modern economy by providing services such as lending, deposit-taking, and money transfer. The rise of the Internet and digital technologies led to the emergence of currencies such as Bitcoin and other crypto-currencies.

Economic security and digital currency

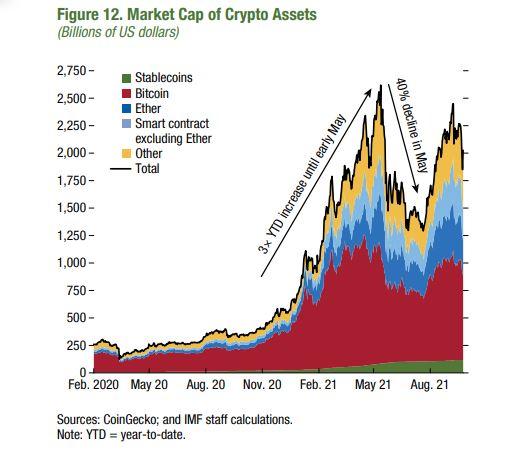

According to P.D. Filippi's ‘Bitcoin: A regulatory nightmare to a libertarian dream’, the influence of technological innovation affects the entire financial services market of technology innovation for the financial market and these advances have changed the economy in general as well as how economic actions might be restricted. All individuals and corporations stand to benefit from these improvements because it is much cheaper and speedier in terms of the payment and it reduces the cost of living of the general public. Bitcoin and crypto-currency are very famous among the other types of digital currencies. According to the Central Bank of Sri Lanka’s (CBSL) ‘Risks of using and investing in crypto-currency’, crypto-currency means the type of virtual currency that is generated by private entities and not by an authority of a country. Bitcoin is one of the dominant crypto-currency types to threaten the post-Bretton Woods system of financial control over global trade. Bitcoin is decentralised and uses a distributed public ledger, eliminating the requirement for a trusted third-party. At this point, Bitcoin appears to be many customers' preference because of efficiency and the low level of the transaction cost, per M. Campbell-Verduyn's ‘Bitcoin, crypto-coins, and global anti-money laundering governance’. As a result of that, customers are more attracted to Bitcoin than other currency types. However, this currency system has significant pros and cons to financial inclusion in the country. According to the World Bank, ‘Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered responsibly and sustainably’. So, it identifies this kind of investment system as insecure for achieving sustainable financial inclusion in the country. However, in a global context, countries like Argentina get advantages in navigating their economic crisis to economic growth by using crypto-currencies. For example, in Argentina, an innovative proposal is to build up to 1% of the national foreign exchange reserves in Bitcoin. Further, in December 2023, Bitcoin was an official currency for legal contracts. On the other hand, in March of last year (2024), the demand for Bitcoin rose to a 20-month high, with Argentinians preferring to buy this crypto-currency than exchange Pesos for dollars, as they have historically done. According to policymakers, Argentina can become the first digital economy and they also achieve significant milestones after their economic crisis because of this new revolution.

Digital currency environment in SL

In the Sri Lankan context, crypto-currencies are not considered legal tender in Sri Lanka and there is no regulatory mechanism relating to their usage in the country. As per Direction Number Three of 2021 under the Foreign Exchange Act, No. 12 of 2017, electronic fund transfer cards are not permitted to be used for payments related to crypto-currency transactions. On the other hand, crypto operates through informal channels. Therefore, it does not contribute to the national economy and also causes a loss of valuable foreign currency to the country. At the beginning of last year, the CBSL decided to introduce Central Bank Digital Currency to the money market at the end of the year. However, after the Parliamentary Election and the new regime started to govern the country, they did not mention any clear statement about the Central Bank Digital Currency. Moreover, the CBSL decided to introduce the Central Bank Digital Currency to the general public as it is motivated to reduce crypto-currency adoption and to help to increase the inclusive growth in the financial sector in Sri Lanka (Ledger Insights’ Sri Lanka plans proof of concept for Central Bank Digital Currency). Further, digital currency provides efficient, low cost means of transferring and storing money, helping individuals build savings. This increased financial inclusion can enhance economic security by enabling people to better manage their finances. On the other hand, if digital currencies are poorly managed, they could increase inflation or lead to the devaluation of the existing currencies. For example, if central banks issue large quantities of Central Bank Digital Currencies without a proper plan, it could create inflationary pressures and underestimate the purchasing power of money, leading to negatively impacting economic security. The anonymity of some digital currencies including crypto can open the door for money laundering and terrorist financing because the authorities may be unable to trace the illicit transactions, The crypto ecosystem falls under different regulatory frameworks in different countries, making coordination more challenging. So, it reveals that the digital currency system wants more resilient international collaboration to regulate the mechanism.

Policy recommendations

Human nature wants a high income but facing low risk. However, in reality, if you want a high income, you want to take a high risk, and that is why modern society is addicted to currency like Bitcoin and crypto. That is why national regulators also prioritise the implementation of existing global standards and ensure effective supervision and enforcement. In developing economies like Sri Lanka, crypto-currency can drive weak central bank credibility, inefficient payment systems, vulnerable banking systems and limited access to financial services. If the CBSL can issue digital currency to strengthen the macroeconomic policies and improve the payment system, it can lead to enhanced economic security and financial inclusion in the entire nation. In the global context, policymakers should prioritise making cross-border payments faster, cheaper, more transparent and inclusive through the Group of 20 Cross Border Payments Roadmap to enhance economic security and inclusive growth throughout the world.

(The writer is an Intern [Research] at the Institute of National Security Studies think tank, under the Ministry of Defence. The opinions expressed are her own and not necessarily reflective of the institute or the ministry)

The views and opinions expressed in this article are those of the author, and do not necessarily reflect those of this publication

PIC 1:

PIC 2: